Trading strategies using trend lines

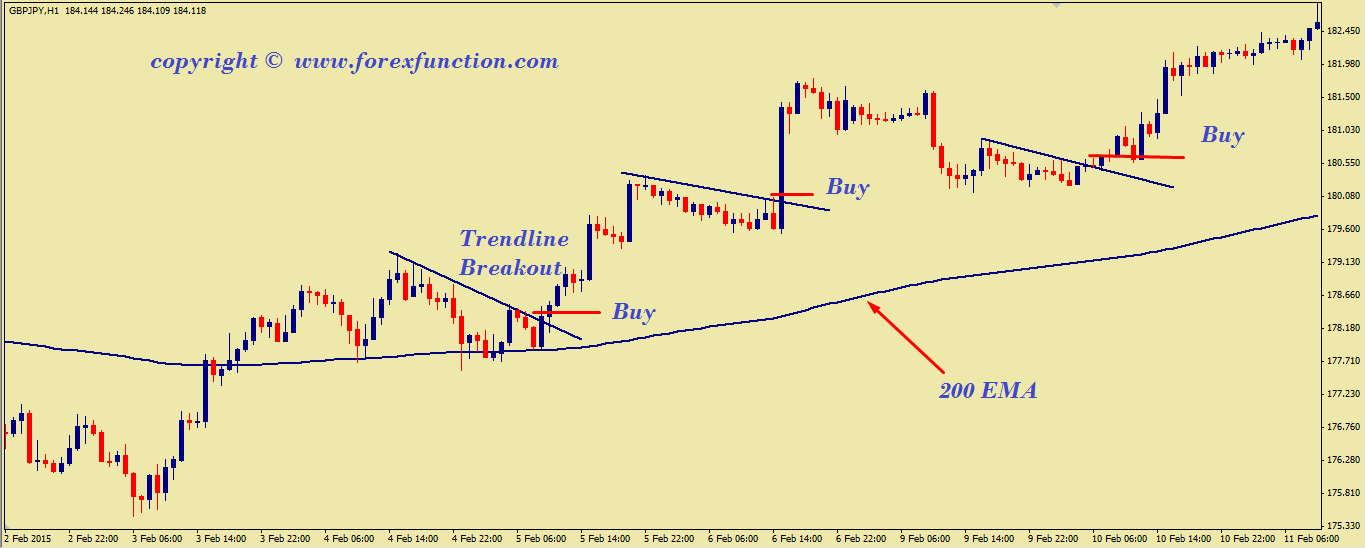

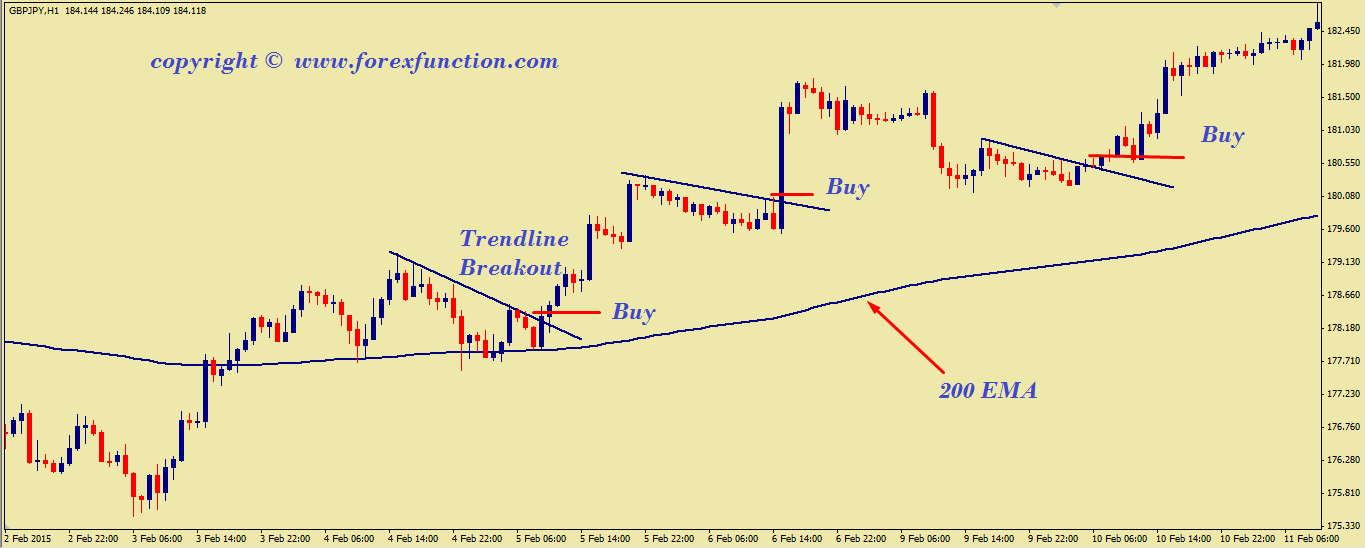

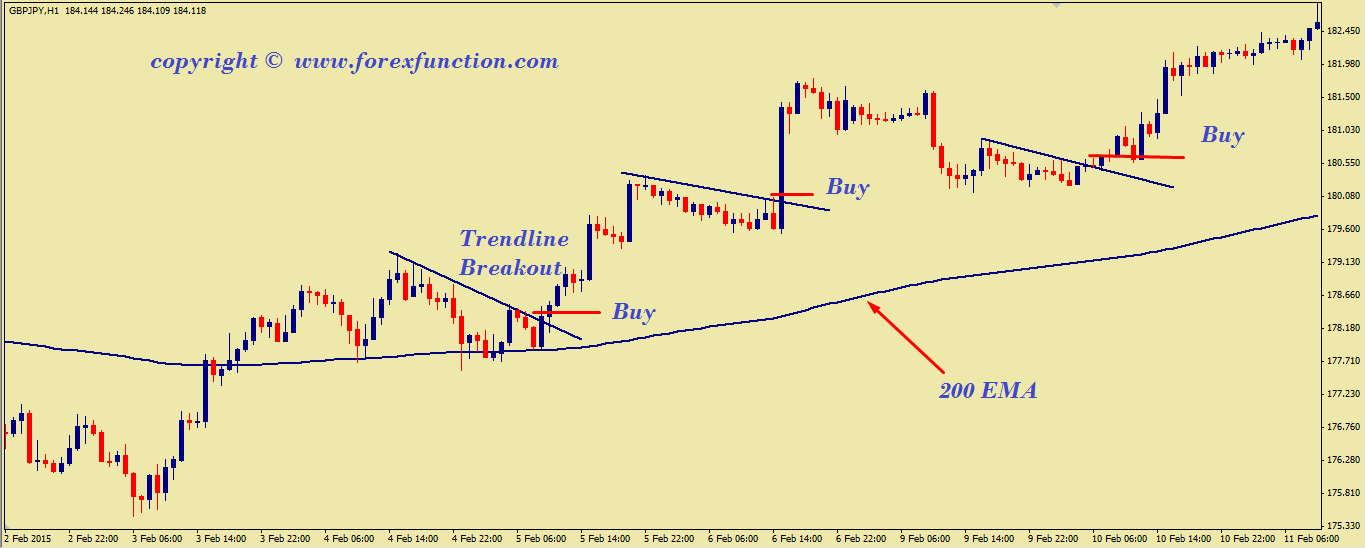

Win cash prizes and community reputation in our unique, intelligenty moderated forex trading contests where every participant gets a fair chance. Our suite of powerful affiliate tools is available to every registered member to refer other traders up to 3 tiers deep and earn up to Join now it's free User Name: Receive Important Email Updates? We Will Beat Any Competitor Rates! Compare Forex Brokers with Rebates. Support Contact our support team any time during the business week with any questions you have. Trading Contests Win cash prizes and community reputation in our unique, intelligenty moderated forex trading contests where every participant using a fair chance. Promotions Exclusive promotions and general forex promotions. IC Markets Demo Trading Contest. RoboForex - coupons for MQL5 signals. Dukascopy - Equity Bonus. Dukascopy - Anniversary Bonus. Lite Forex - Non-stop Bonus. EasyMarkets - First Deposit Bonus. IC Markets - Free VPS Service. Global Prime - Free VPS Service. STO - Free VPS Service. FxOpen UK - Free VPS Service. FxOpen AU - Free VPS Service. Synergy FX - Free Beeks FX VPS. Orbex - Free VPS Service. FXCM UK - Free Forex Trading APP. Industry Leading Affiliate System and Rates Our suite of powerful affiliate tools is available to every registered member to refer other traders up to 3 tiers deep and earn up to Build Your Referral Business. How much do I get paid? Webpage Code for Your Website. Forex Industry News, Aggregated. Add our tools to your site. Glossary Glossary-A Glossary-B Glossary-C Glossary-D Glossary-E Glossary-F Glossary-G Glossary-H Glossary-I Glossary-J Glossary-K Glossary-L Glossary-M Glossary-N Glossary-O Glossary-P Glossary-Q Glossary-R Glossary-S Glossary-T Glossary-U Trading Glossary-W Lines Glossary-Y Glossary-Z School Home Introduction to Forex What is Forex? FX Advantages Over Stocks and Futures Reflections of a Trader in the World of Stocks Reflections of a Trader in the World of Commodities Reflections of a Trader in the World of Options What do I need to get started? Forex Basics Currency Pairs Pips and Profits Transactions Costs - Spreads and Commissions Overnight Interest, Rollover or Swap Rate Leverage, Lots and Margin Trade Order Types Chart Types Market Hours Best Hours, Days and Months to Trade Currency Pair Correlations Risk and Money Management Caution! Market Maker with a Dealing Desk Two Non-Dealing Desk NDD Broker Types: STP and ECN Forex Regulation in the USA NFA Regulated US Brokers Three Popular Non-US Regulated Jurisdictions: Britain, Switzerland and Australia Easy Account Opening and Funding Methods Benefits of Higher Leverage Benefits of Micro Lot Trading Broker Custom Service Decent Trading Platform and Software Example of Narrowing Down a Broker Types of Trading Technical Vs Fundamental Analysis Trading Styles: Day, Swing, Position Scalping Trading Scenarios for Scalping Grid Trading: Pure and Modified Martingale Trading: The King of Currency Flows Business Cycles and the Relationship to Interest Rates Central Bankers Risk Aversion: The Goliath of Price Movement Intermarket Correlations US Dollar Fundamentals US Dollar Overview: Declining Internally and Internationally Interest Rates: Ultra-loose 29 Year Downward Trajectory Fed Money Creation: Hyper-Active and Inflationary Inflation: Cumulatively Creeping and Leaping Upwards US Debt: Enormous and Destructive to US Economy and Dollar US Trade Imbalances: Optimization of Setup Strategy Design: The Entry Technique Optional Strategy Design: Money Management BackTesting Optimization Steps to Minimize Overoptimization MQL4 Guide to Building an Expert Advisor Introduction Basic Concepts Simple Logical Operators Basic Structure of an EA Basic EA: MA Cross Working with Price Data Order Counting Functions Retrieving Order Information with the OrderSelect Function Market Orders with the OrderSend Function Pending Orders with the OrderSend Function Closing Orders with the OrderClose Function or Custom Close Function Constructing Trade Conditions Building Strategy Conditions with Indicators Building Strategy Conditions with Oscillators Preparing Custom Indicators for Strategy Deployment: Coverting into iCustom Functions Building Strategies with Custom Indicators and the iCustom Function Example: NonLagMA Using Trend Filters to Trend Strategies Money Management: Lot Sizing TrailingStop with Profit Threshold Auto Define Slippage and Point Values for 5-Digit Brokers Enter on Open Bar Multi-Session Time Filter with Auto-GMT Offset Trading Days Filter, with NFP and Holidays. Show Forex Dictionary links. Flex Site Full Width Site. Digital Family US Forex Brokers RebateKingFx. Company Information Contact Us Our Blog Facebook Twitter Website Guides and Rules Webmaster Tools. Forex, Futures, and Options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. This website is neither a solicitation nor an offer to Buy or Sell currencies, futures, or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. Website owners and affiliates will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. An e-mail with your verification code has been sent to your e-mail address. Please access your in-box and use the verification button or verification code to complete your registration. You already have an account linked with this E-mail it maybe standard or social login. Please, sign in with it. Please, provide us your e-mail so we can verify your account. Keep me signed in. Markets can trade horizontally, but they often trade diagonally, forming uptrends and downtrends. Trendlines are plotted along the uptrends and downtrends in order for the trader to quickly visualize the strength and slope of a given trend on a given timeframe, so he can enter in with the trend at retracement points or at breaks of the trend at trend reversals. It can be argued that some of the most profitable trading boils down to simple support and resistance trendlines and that all the numerous, complex mathematical indicators are just distracting clutter and noise that lags the market and slows trader reaction time in quickly market movements. The fact is, the market is run by the traders at the banks, and they are using trendlines along with fundamental ideas of direction more than indicators. Thus, it trend any trader to learn as much as he can about trendlines, how to plot them properly, and exploit them effectively. There are a number of questions this article seeks to answer to help you become a better trendline trader: A trendline is a straight line that starts at the beginning of a trend and stops at the end of the trend. Note on Picking Timeframes First you pick a chart timeframe, bearing in mind that each timeframe can show different movements and different trends, and since these charts are always shifting, never the same, the trends are always changing. Some trends are forming, others are continuing, some are breaking, and others are reversing. Charting is a dynamic process. Today's trend can be reversed tomorrow. The daily chart can show us in an uptrend while the H1 chart can show us in a downtrend. You may not be able to see or place a trendline on certain charts. Currencies are not trending constantly, for sometimes they may be caught in directionless range or channel. However, because you have so many different timeframes to choose from, there is a good chance you can spot a trendline on one of the timeframes, though it is best if you can see confirmation of the trendlines on multiple timeframes. Some trends can be orderly and easy to spot, while others can be disorderly and harder to see. In general, we aim to start and stop the trendline at obvious highs and lows. Spot an obvious low and carry your eye along higher highs tops and higher lows to an obvious high. Take a look at the chart. The first line, starting from the left, starts at a low and ends at a high. In general, upward sloping trendlines are used to connect prices that act as support while the given asset is trending upward. This means that upward sloping trendlines are mainly drawn below the price and connnect either a series of closes or period lows. The Entry Rules Start at the lowest low and connect the line to the next low that precedes a new high. As long as the new highs are being made, redraw the line to connect to the lowest low before the last high. When prices start making new highs, stop drawing. Extend the line out into the future at the same slope. The upward trendline illustrates the support line. The next trendline is a downtrend. It trend at a high and goes to a low. In the case of a downtrend, your eye starts at an obvious high and follows successively lower highs and lower lows bottoms to an obvious low known after the fact. A downward sloping trendline is generally used to connect a series of closing prices or period highs that act as resistance while the given asset is trending downward. The Entry Rules Start at the highest high and connect the line to the next high that precedes a new low. As long as the new lows are being made, redraw the line to connect to the highest high before the last low. When prices stop making new lows, stop drawing. The downward trendline illustrates the resistance line. Quest for Objective Trendlines: TD Trendlines The problem with traditional trendlines is that they trading subjective; ten traders could look at the same chart and draw 10 different trendlines. TD Lines require a trendline to connect "TD Points" commonly called "pivot" highs or lows, or "swing" highs or lows. For an interesting summary of the methodology, click here. Auto-Draw TD Trendlines If you like the Tom Demark's more objective way of handling trendlines, and you don't want to put in the work of manually lining up the pivot points and lines, you are in luck. You can use a custom indicator called DeMark Trendline Trader to auto-generate these lines for you: DeMark Trendline Trader Using this indicator can help you practice and learn how to identify TD Trendlines easily and effectively. The price will bounce off the trendline and continue in the direction of the prior trend; It will move through the trendline, which can then be used as a sign that the current trend is reversing or lines. There is thus a strategy that be adopted for each scenario. You have probably seen many pairs take off in one direction for a sustained period of time but have been too shy to get on board because of the fear that of getting in too late. You fear that you will get in at the moment of price correction, a correction that manages to take out your stops before the underlying trend kicks in again. Buying at the Upward Trendline Support The more times that a low of the time frame touches the support line without crossing it, the more confidence you should have that is a valid description of the trend. This is called a test of support and encourages buyers to buy more after the price passed the test. Often traders engineer a test of support by selling the currency down to the support line to see if the support will hold. If you put on a new position above the support line, you might have to bear some damage when traders test support. Will buyers rush in to support the currency? The reason that this strategy can work so well is: Buy when the low of the bar reaches within a predefined number of pips of the support trendline. Let us look at an example of a recent chart of EURUSD on H4 timeframe: You can see that the trendline had begun to form on March 28 at the first significant low, and the next low had confirmed it. The third low, which I have named Buy 1could have been a nice spot for traders to take up buy positions for a 50 pip gain, but for most traders it would have represented another confirmation point for the trendline support. After that point held firm, trendline traders would have drawn and highlighted the support trendline above, and put in buy limit positions at Buy 2taking the EURUSD from 1. At that point in time, it would have looked like the trendline would never be touched again, as it was so far above. It can be the nearest level of support or resistance according to Pivot Point Levels. Exit the buy position when the low of the bar falls below the support trendline by a predefined number of pips. This predefined number of pips should be based on the average true range ATR of the currency pair for that time frame. Thus, in Buy 1 and Buy 2, you would have suffered very little DD risk for the profit taken, as the trades bounced soon after touching the line. However, in Buy 3, you may have taken your trade from the line at 1. If you had only a fixed pip stop loss on your trade, you would have been stopped out just before the correction had occurred. The average true range method would have been enough wiggle room to keep you in the rubber band trade as it stretched as far it could go before snapping back. When any part of the price bar penetrates the line on the downside, support may have been broken, or the trendline becomes unreliable. If the move continues to the upside after the trendline is broken, the trendline becomes unreliable. A breakout is any part of the price bar penetrating a line that you drew on the chart. Strategies traders require that to qualify as a breakout, the bar component that breaks the line has to be the close. Sometimes the offending breakout is quickly roped back into the herd, but usually a breakout means that the trend is changing direction, either right away or sometime soon. Selling at the Downward Trendline Resistance The more times that a high of the time frame touches the resistance line without crossing it, the more confidence you should have that it is a valid description of the downward trend. This is called a test of resistance and encourages sellers to sell more after the price passed the test. Just as traders engineer a test of support, they engineer a test of resistance. You are hoping that the sellers will rush in to hold the resistance line, and if the resistance holds, traders who were buying will become sellers. Sell when the high of the bar reaches x number of pips of the resistance trendline. Let us look at an example of a recent chart on the USDCAD on the D1 time frame: I am starting the downtrend on the chart above for this year only. I start with a swing high on Dec 20,and get second swing high on Jan 31which allows me to form the downward trendline resistance. Trendline traders would have drawn the same trendline and taken short positions at the approximate area of the trendline. The first short position Sell 1 came at Feb 10,at 0. The second short position Sell 2 followed in the same month at 0. The third short position Sell 3 came on March 15and it would have been much trickier to stay on board with this one without getting stopped out. One would have entered around 0. If you had managed to be still in the game, you would have seen the market fall lower to 0. Exit when the high of the bar reaches above the resistance line by a predefined number of pips. As mentioned before, I prefer an average true range based on the currency and time frame in question than a fixed stop. In either case, you would have been able to take Sell 1 and Sell 2 with very little open DD, as the trades touched the line before descending. Only a fixed stop of pips or more would have let you survive that trade. Sell 3 was very tricky, and only the more veteran trendline traders would have had the balls to jump back in after being stopped out. The above strategy helps traders enter or stay in a trend. The trading mistake is staying in the trend after the trendline is broken. Sometimes new traders will be resistant to take a loss, and they keep giving the trade more wiggle room, hoping it comes back. They may even draw in new, flatter trendlines, hoping the market stays bound by them. However, a trader should always remember that if the reason for staying in the trade is no longer valid, it is the trader's job to take a small loss and move on to the next trade. All traders should be prepared for both the bounce and the break. It is a matter of keeping your mind and eyes using to both possibilities, which can be harder than it seems. Usually when we trade for a specific direction, we develop a psychological bias for that direction, and we are reluctant to swing degrees around and take a trade in the opposite direction. It would be ideal if we were so flexible, though usually what takes place is that we side with one method or the other. For instance, if the daily or H4 time frame is strongly bullish, you would want to place a buy stop for a breakout through a downward trendline taking place on a H1 or M30 time frame. That way you will be trading with the larger trend current, which would give you a better edge than otherwise. Draw a downtrend trendline or uptrendline using the rules drawing trendlines lines above, or auto drawn using the DeMark Trendline Trader indicator. Choose a timeframe that illustrates the setup with the best slope, with preference given to higher timeframes over lower ones. The entry is done on the breakout of the downward trendline or the breakdown of the upward trendline by a predetermined number of pips. The predetermined number of pips should be appropriate for the currency volatility and time frame. Usually a break of the trendline by 10 pips should be sufficient. Example of GBPUSD on H1: I could see a very interesting downward trendline resistance had using on two swing highs solid red lineand since the larger trend was up, I chose to have a buy stop entry 10 pips above the trendline dotted red linewhich was hit at 7: Three bars later it hit my 60 pip profit target. Not only did I automate my trendlines using the DeMark Trendline Trader, I also automated my buy stop entry using the help of a semi-automated EA. Since I was about to go to bed at 3: I wasn't about to lose sleep trying to follow the path of the trendline, manually readjusting the buy stop at each new bar. Thus, I investigated a number of semi-automated trendline EAs out there, and the one I eventually chose to use was the free iDRAW EAan enhanced version of the TrendMeLeaveMe EA download TMLM EA here. I only needed to rename my trendline object on the chart to buystop1indicate the offset already defaulted to 10 pipsand thenceforth the buy stop would appear 10 pips above the trendline in the dotted line and auto-adjust itself as the trendline and market continued forward. It also allowed me to choose a stop loss and profit target, and I chose a stop loss of 30 pips and profit target of 60 pips. You may even want to experiment with timeouts, counting the number of candles before the target is reached, and if it is not reached in x number of candles, you close out the trading positions. You can have it a couple of different ways. Or you can determine a stop loss that is the 7-period average true range of the currency and time frame in question. The Risks of Trading Trendline Breaks: A trendline breakout doesn't necessarily lead to the formation of a trend in the opposite direction. Sometimes it can lead to a resumption of the same trend. A move upward that occurs after the first breakout above the resistance line is called a retracemen t, correction, or pullback. At the time it is occurring you don't know whether it is a full trend reversal or just a retracement. It is thus always wise to employ a stop loss. A one or two bar break of the line that reverts back to the trend is called a false breakout. It is called false because it proves false your conclusion that the breakout will continue on the path of a trend reversal, when in fact it is just bait to lure the breakout traders into a losing trade that ultimately reverts back to the trend. Traders have discussed different ways of confirming the validity of the breakout. One method is to wait for the close of the breakout bar; if the close is above the downward trendline, it helps to confirm the breakout. The downside to this confirmation is that it forces you to get in on the trade later, and thus miss part of the move. Alternatively, master trader Larry Williams recommends that one consider the position of the close of the day before the strategies. If one is trying to work a buy breakout, and if the close is at or near the high, chances are good that it's a false breakout; if the previous day was a down close and then broke out, chances are the breakout is real and the market will go higher. The downside to William's confirmation is it forces you to doubt the breakout potential of bars that had a preceding bar close near its high, and thus you might miss out on breakout opportunities that proved genuine despite William's prediction. Thus, a filter for the close of the breakout bar or the preceding bar can cause traders to miss part or all of the breakout move, and it is sometimes best to trade without such filters, knowing ahead of time that the breakout can ultimately be a false breakout and resumption of current trendand that is why you are using stop losses. Wrap Up Ideally, once you have mastered how to draw good trendlines by hand or via automated indicators, you can zoom in and out on multiple time frames, searching for the time frame where it looks like traders are lining up to support a downward trendline support or a upward trendline resistance. To better determine if you should be taking bounces or breaks from these identified trendlines, you should be first familiar with the trend taking place on the larger time frame. If the technical and fundamentals suggest that the larger trend is up, you would best to look for bounces from upward trendlines or breakouts from downward trendlines on smaller time frame intervals. If the technical and fundamentals suggest the larger trend is down, you would best to look for bounces from downward trendlines or breakdowns from upward trendlines on smaller time frame intervals. Every once and while there is a break or bounce from a daily time frame itself, and if a definite break occurs, you should be prepared to switch gears; that is, if you were formerly bearish, you will be become bullish, and vice verse. The daily bar break is a powerful break, and a lucky opportunity if you can find it. However, if you miss the initial breakout of the daily bar, you can always play the retest, the pullback to the support or resistance bar strategies was just broken, allowing traders who did not get in on the initial breakout a second chance to get in. You would then have the benefit of having former support become resistance, and the former resistance become support. Trendline trading thus illustrated calls for the instincts of a hunter, inclining one to follow the path of the big game the larger trendat the same time tracking the zigs and zags of different time frames, trading with the herd on the bounces from "strong" trendlines, and setting traps stop entries on the breakouts of "weak" trendlines that dare to counter the larger trend.

Amaro said his club has talked to 20-25 teams about trades, some of which he said would surprise Philadelphia fans.

And the strength is fed by keeping the charade going, whisking the propaganda, beating the drum, laying more levies and taxes on Western Nations.

I participate in Operation Access and we can help FTM guys whom are uninsured or under insured get hysterectomies.

And while some are studying to supplant their neighbors, and others striving to keep their stations, one villain will wink at the oppression of another, the people be fleeced, and the public business neglected.

U.S. Department of Commerce, Office of Program Evaluation and Risk Management Skip to Navigation.