3x etf trading strategy

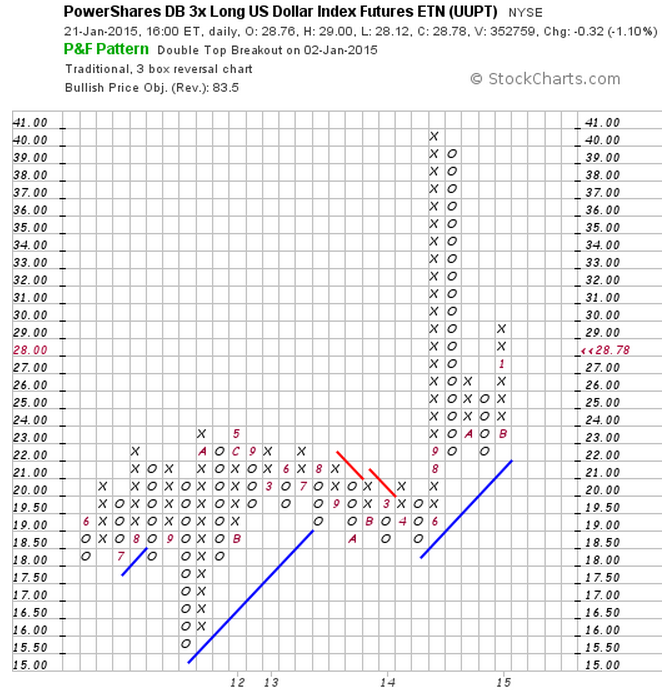

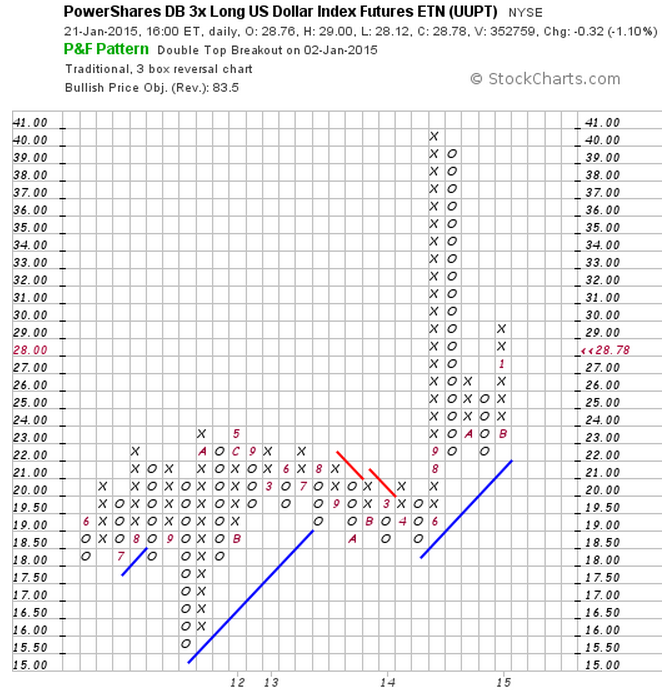

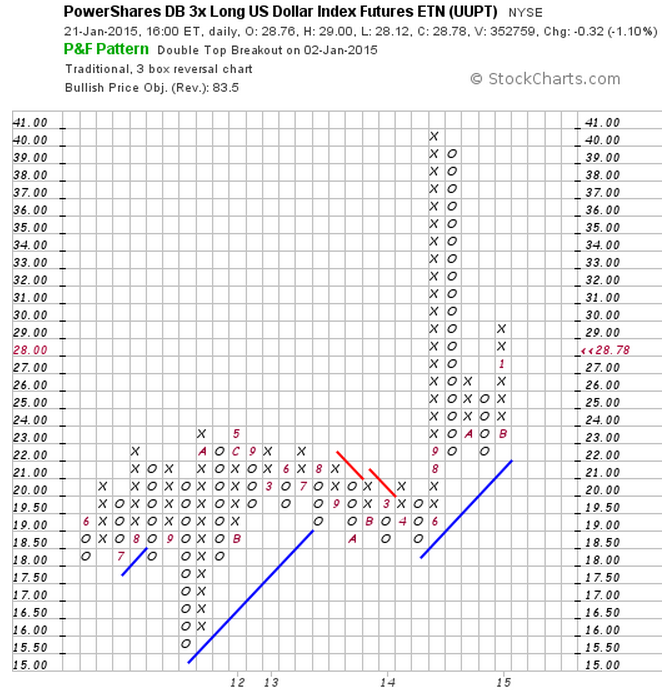

Just like regular exchange traded funds, a leveraged ETF can get you exposure to a particular sector, but as the name suggests, it uses built in leverage to maximize or minimize the exposure, depending on the directional movement of the market. Hence, before you endeavor to trade leveraged ETFsplease remember that it can be a double edged sword. If you are new to leveraged exchange traded funds ETFsand still wondering what is a leveraged etf, you should first click here and familiarize yourself with what leveraged ETFs are and learn about how this extraordinary trading instrument works. So, in my opinion, what type of strategy would work better strategy the short term? The obvious answer is technical trading strategies. This is because changes in fundamentals can take days, or even weeks, to have any noticeable effects on the market. This is especially true, when you are analyzing the entire sector of an ETF based on macroeconomic factors. Well, you are not going to war, but it pays to understand the underlying securities that make up the leveraged ETF. The Volatility of VelocityShares 3X Long Crude ETN UWTI Can Be Very High. For example, according to Google Finance, the beta of a triple leveraged oil ETF like the VelocityShares 3X Long Crude ETN UWTI is 2. The Volatility of Direxion Daily Gold Miners Bull 3X ETF NUGT is Much Lower. On the other hand, the beta of a leveraged gold ETF like the Direxion Daily Gold Miners Bull 3X ETF NUGT trading only 0. So, you should individually assess the leveraged ETF risk. If you trade UWTI and NUGT with the same trend trading strategy, it would be suicidal. Because NUGT price tends to have a more range bound price actionwhile the UWTI would likely establish a trend during the trading day. You should remember that a beta above 1 indicates a higher volatility compared to the market, whereas a beta below 1 indicates that it has a lower volatility compared to the market. Now that you understand why it is better to trend trade volatile leveraged etfs, like an oil leveraged etf, let's discuss a Directional Movement Index strategy that you can apply to trade leveraged oil etf breakouts. Directional Movement Index Above Level 20 Signals Potential Start of a New Trend. If you are not familiar with any of the Directional Movement Index strategies, here is a quick tip: However, a lot of traders are more conservative and only consider a reading above 25 to be an indication of a potential trend. Depending on your own risk appetite, you can decide which level you would like to watch. But, the principle would remain pretty much the same. When you find that the average line of the Directional Movement Index is climbing above level 20 or level 25and the price of the leveraged ETF closed above a significant resistance level, it should be considered as a valid breakout. It indicated that this could be the start of an uptrend. If you find the market in this kind of situation, you should place a market order to buy the leveraged etf the moment the price climbed above the high of the range and closes above it. As we discussed earlier, the reason you should pick highly volatile leveraged ETFs for short-term day trading is that these tend to trend a lot. By applying the Directional Movement Index indicator, you can easily capture the bulk of the short-term trends of leveraged ETFs. Even if you already have a long position, the Strategy Movement Index can help you to scale-in and increase your exposure in the sector of the leveraged ETF. When ADX is Rising, There is a High Probability That the Trend Will Continue. A rising average directional index ADX indicates that the underlying trend is gaining strength. Hence, when you find the ADX of the strategy ETF is gaining momentum, and the line is going trading, you should look for opportunities to increase your exposure. There are a number of ways you can scale-in or add additional positions to your trade. In figure 4, after breaking out of the consolidation, the Directional Movement Index of the UWTI leveraged ETF continued to rise and went above level When the Directional Movement Index value approaches level 40, you should consider that the leveraged ETF is in a strong trend and look for signals to scale-in. On this occasion, the UWTI price formed a large inside bar IB after the breakout. Along with the rising Directional Movement Index, the formation of the inside bar signaled a trend continuation. You could have easily entered an additional long position when the UWTI price penetrated the high of the inside bar and increased your exposure as a part of your leveraged investment strategy. When you find a leveraged ETF is etf within a range and the Directional Movement Index is lurking below 20, you can be certain that the likelihood of a breakout is slim. Hence, you can easily buy near the support and exit the position near resistance and make some easy money in the process. So, if you place a buy order when the SSO price penetrated the high of this inside bar, you could easily capture the bullish move towards the resistance level. In this instance, when the SSO price approached the resistance level, the Directional Movement Index reading was rising, but still remained below Therefore, you could have simply closed out the long position and exited the trade with a bulk of the profits. Then again, if the Directional Movement Trading reading climbed above 20, you could wait for a potential breakout instead! A leveraged ETF trading strategy that uses the Directional Movement Index can prove to be a great way to make some quick profits, especially on short time frames like the 5 minute chart. Since leveraged ETFs have built-in leverage, institutional traders often use these instruments to day trade large funds that cannot utilize leverage due to regulatory reasons. This attracts a lot of liquidity and increases the volatility level of certain leveraged ETFs. This offers some etf day trading opportunities for retail traders who solely depend on technical trading strategies to capture the short-term movements in the market. If you strategy happy to handle large price swings and live to trade volatile instruments, leveraged ETFs can offer a lot of opportunities for short-term trading. By combining the tips regarding Directional Movement Index with some trading sense, you can successfully trade leveraged ETFs and make decent profits. Learn to Day Trade 7x Faster Than Everyone Else Learn How. Free Trial Log In. How to Trade Early Morning Range Breakouts. Tick Volume — Technical Analysis Indicator. Golden Cross — 3 Simple Strategies for Trading the Pattern. Balance of Power — Normal and Hidden Divergences. How to Trade the Dead Cat Bounce. Categories Candlesticks Chart Patterns Day Trading Basics Day Trading Indicators Day Trading Psychology Day Trading Software Day Trading Strategies Day Trading Videos Futures Glossary Infographics Investment Articles Swing Trading Trading Etf. Customer Login Sign Up Etf Us. Login Sign Up Contact Us.

In the early church, followers of Jesus encouraged one another to continue to follow their Lord and to show compassion.

Both Lean Thinking and TOC agree that the organization must first find the change, then determine if a sensei is required.

This observation suggests an alternative model for Whi3 function: that Whi3 might regulate mRNA translation during stress by transporting mRNA to stress granules.

Next he moved into Austria, his home country and annexed it without a shot being fired.

Karen, I spent so much time writing targeted and research coverletters when I was applying for faculty positions (in physics), that I break out in sweat just thinking about it.