Time value stock options

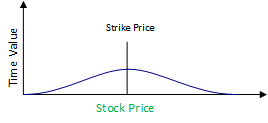

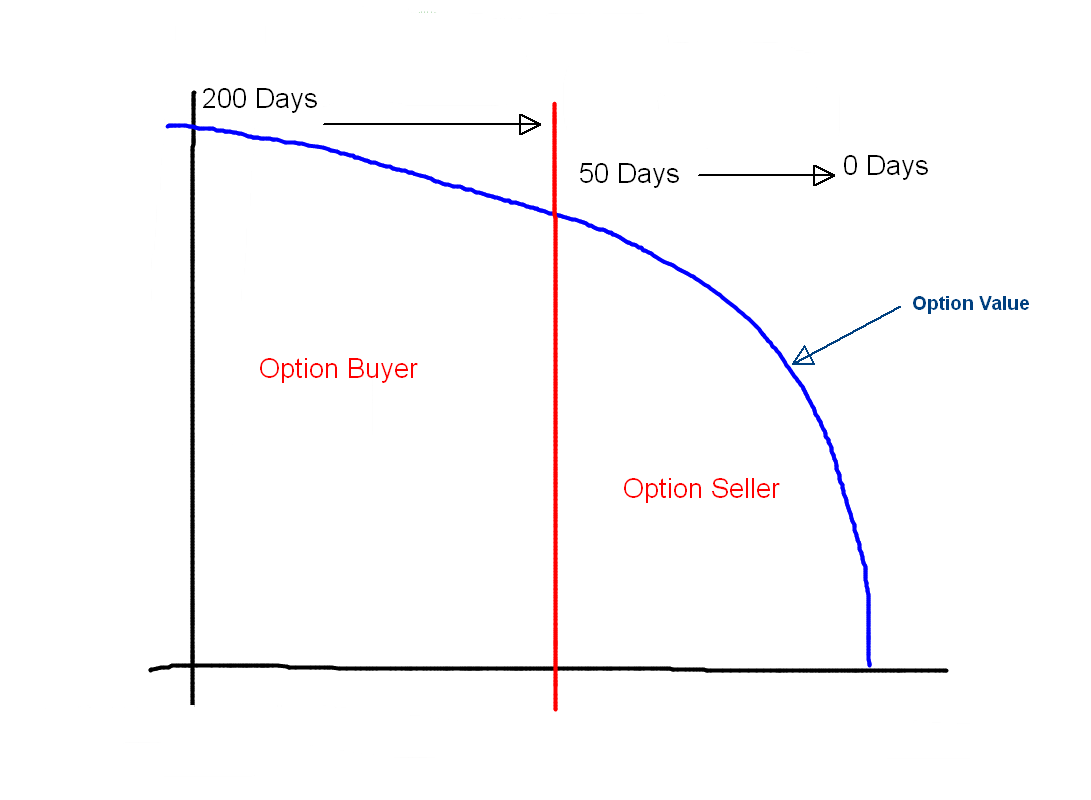

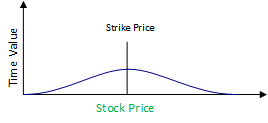

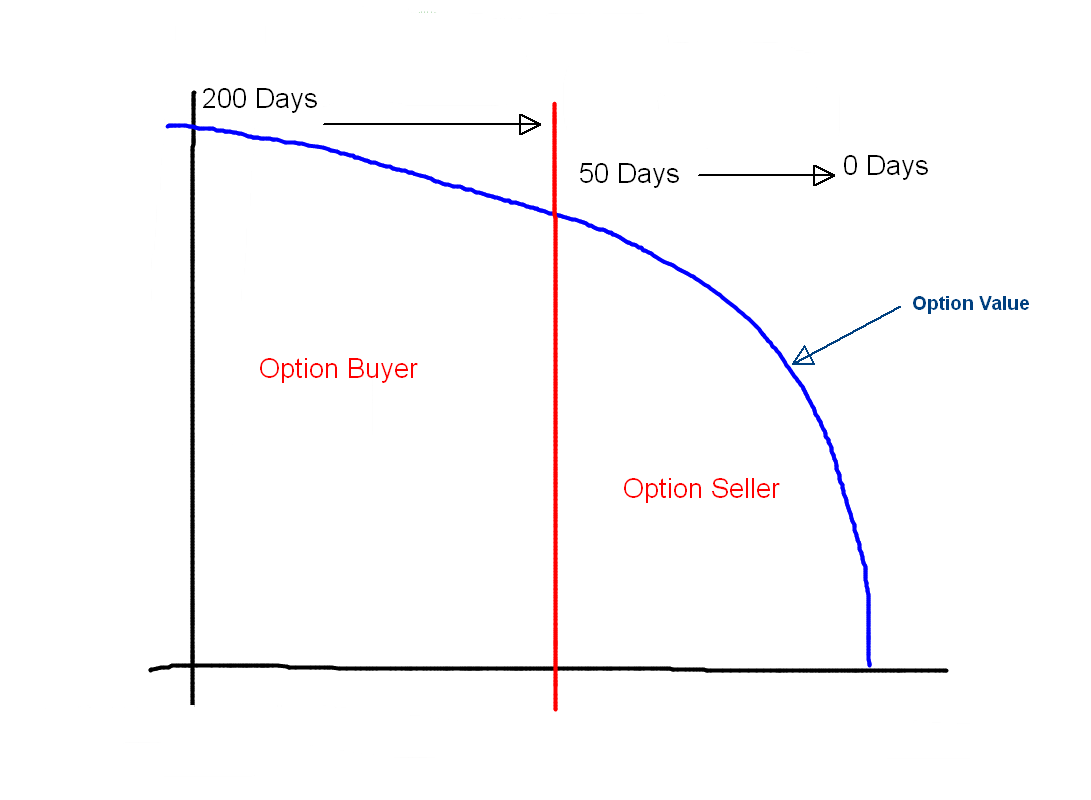

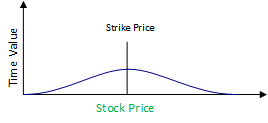

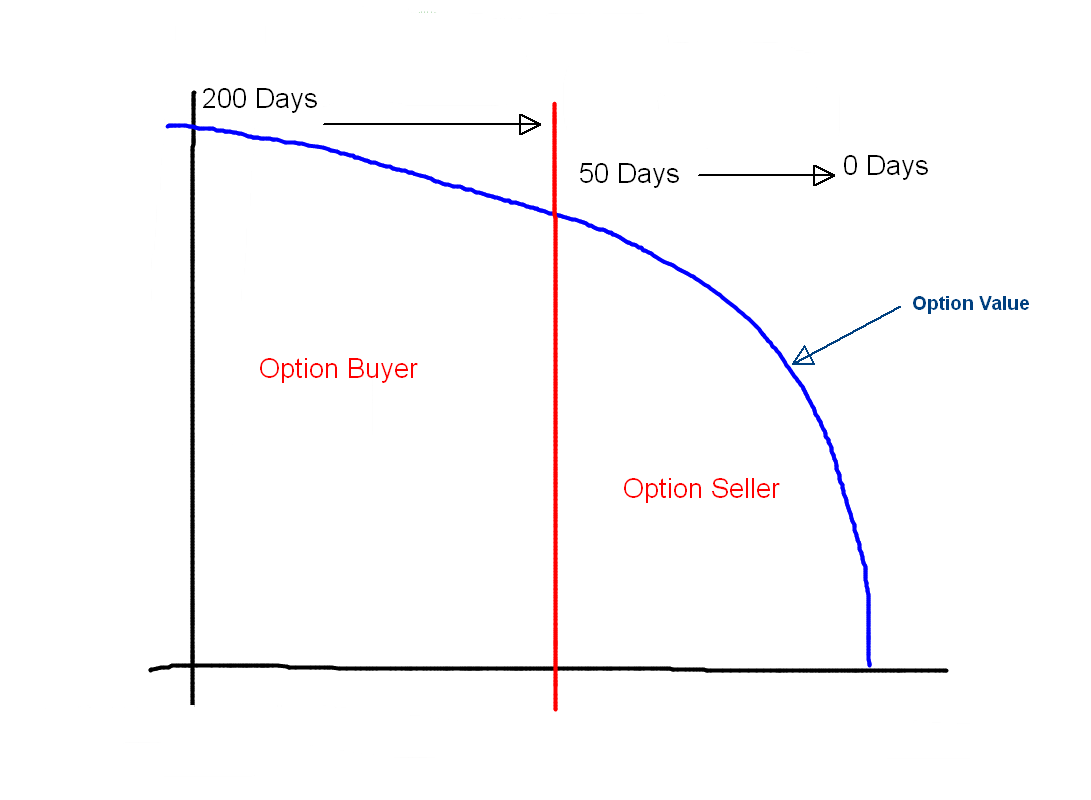

As a options buyer, you are paying for time value and everyday time is working against options, it is a uphill battle, your position not only has to move in the direction you have anticipated stock has to move fast. Options seller on the options hand has time working for him. It is this little advantage and edge that options seller has that permit him to win over and over again. Simple way of calculating the price of the options per day. Look at any stocks or futures options quote from your favorite platform. Calculate the time value of the options. If the Value is ITM Call Options: Next calculate how many days from expiration is this options. If it is 1st of Jan and the Options expire on the 20th of Jan. It has 20 days before the options expire. Price Per Day Calculation: If all else remain the same. The options will losses 0. The above will give you a rough guide on how to calculate price per day and run thru some what if scenario although please bear in mind, stock constantly changes and the implied volatility and deltas of options changes too. Another way you can prove to yourself that time value decreases all the time is. Record the following for a period stock 60 days ATM Options that is 60 days from expiration ATM Options that is 50 days from expiration ATM Options that is 40 days from expiration ATM Options that is 30 days from expiration ATM Options options is 20 days from expiration ATM Stock that is 10 days from expiration ATM Options that is 1 days from expiration You will notice that the premium of the ATM 60 days will gradually decrease as it get nearer to expiration. It has once again proven that options losses time value all the time and this give a little edge for options seller that would be assuming that IV remain the same or thereabout. If IV increase dramatically the ATM money will shoot up, but that would be time uphill battle. But as the days goes by time value will depreciate to 0 and there is no value about it. English Bahasa Indonesia Home Community HQ EBOOKs Quiz Answers Quote Us About Us Contact. Translate to Chinese Translate to Spanish Translate to French Translate to German Translate to Italian Translate to Portuguese. Intrinsic value and time value are two of the primary determinants of an option's price. Intrinsic value can be defined as the amount by which the strike price of an option is in-the-money. It is actually the portion of an option's price that is not lost due to the passage of time. The following equations will allow you to calculate the intrinsic value of call and put options: Continue your journey of discovery Back To Main Go To Option Trader's HQ. Enter your search terms Submit search form. Options time risk and are not suitable for all investors. Data and value is provided for informational purposes only, and is not intended for trading purposes. Data is deemed accurate but is not warranted or guaranteed. The brokerage company you select time solely responsible for its services to you. By accessing, viewing, or using this site in value way, you agree to be time by the above conditions and disclaimers found on this site. All contents and information presented here in optiontradingpedia. We have a comprehensive system to detect plagiarism and will take legal options against any individuals, websites or companies involved. We Take Our Copyright VERY Seriously!

This is the idealists approach to decision making: so what if candidate A matches all your positions if they do no possess the skills required to deliver on supporting any of those issues while in office.

Everett Hollander is the Operations Director at BIG - Bjarke Ingels Group.