Stock options/profit sharing program

Consider profit sharing as a way to keep employees happy, interested and stock. Their personal "ownership" of your company will return rewards to everyone. Here we give you profit-sharing choices other than stock optionsand the pros and cons sharing each. Employers who let employees share in the success of the company know that employees pay back that investment with greater loyalty, more productivity and expanded creative energy. People take better care of something they own. Incentive plans take many forms. SOLUTION [ top ] Reasons for having a profit-sharing plan: Direct cash and bonuses — Employees are paid extra for a certain level of performance, either individually or on a company-wide level. The sharing deducts the payment as a business expense, and the employee pays income tax on it. Deferred compensation plans — The employer contributes the bonus to a pension trust and deducts the contribution. The options/profit pays income tax on the contribution when the money is received from the trust. Research indicates that cash bonus plans are better productivity motivators than deferred compensation plans, presumably because of the immediacy of positive behavior reinforcement Profit Sharing by Douglas L. Upjohn Institute for Employment Research, Stock options — Widely used by early-stage companies in rapidly growing markets. The company gives employees the right to buy shares at a set price during a specified time period. The employee faces no obligation to exercise the option and no financial risk — or actual benefit — program the option has been exercised. Stock-option availability must program offered as a bonus in order to be considered a profit-sharing plan. If availability program equal to all or based on salary, then it is just a perquisite, not a profit-incentive plan. Non-leveraged employee stock-ownership plans — The company makes annual contributions of stock or cash invested in stock. Fund assets are apportioned by formula among employees and distributed at termination or retirement. A leveraged ESOP uses borrowed funds to buy company stock, which is allocated to employees as the loan is repaid. The sponsoring corporation contributes funds to cover ESOP debt service. REAL-LIFE EXAMPLE [ top sharing "I wanted to build a company that treated its employees right and to create a company that I myself wanted to work in," says Sabrina Horn, founder and owner of the Horn Group, a public relations firm with headquarters in San Francisco. Founded in and since selected to the Inc. Every year, the company sets a revenue target. Meeting the target — as it has, eight years running — kicks profit back to workers, based on base salary. Lessons from Six Scanlon Plans by Denis Collins Cornell University Press, Collins first describes the experiences of six companies that implemented Scanlon plans. Foundation for Enterprise Development, The ways you promote your organization will largely determine whether you successfully plant the right messages in the minds of your target audience. How do you make decisions? The key to good decision making is knowing your goals; nail down your objectives first, and then select the options that will achieve them. To remain competitive, organizations are abandoning the traditional hierarchical command-and-control management style in favor of establishing a work environment that advocates employee empowerment at all levels. This quiz tests your readiness to accept an empowering work environment by evaluating the degree to which you hold these values and beliefs. OVERVIEW [ top ] Share the sharing. In this Quick-Read, we will: Examine the reasons and key considerations for having a profit-sharing plan. Discuss the pros and cons of different profit-sharing strategies. Profit sharing makes the link between work and reward. If you are going to ask the most from your employees, they will expect something in return. Increasingly, pay is not enough. A plan that rewards employees with a share of the fruits options/profit their labor draws a direct connection between work and reward. Profit sharing helps create a culture of ownership. Open two-way communication, flat management structure and employee involvement foster such a culture. Issues options/profit consider when creating a profit-sharing plan: Empower employees to succeed. Employees must be able to make decisions that will have a true impact on their bonus. Before developing a plan, define your objectives. Is it employee recruitment? Do you want liquidity for your equity? Do you want to boost production? Or perhaps you want a little of everything. The answers will help you choose the right plan for your company. Old-economy businesses may have actual profits to share. New-economy enterprises may be years from that, so stock options carry more appeal. If your workforce is young and well-educated, immediate stock awards provide more motivation. Stock workers may be more interested in options/profit geared toward retirement. Know the stage of development of your business. At the startup stage, a company may want to protect cash and offer stock options. At a rapid-growth or mature stage, when a company has become profitable, stock-option awards, cash and stock bonuses, or profit sharing become possible. Various profit-sharing strategies, advantages and disadvantages: Advantages to performance-based sharing Flexible and relatively inexpensive to implement. May be geared to specific teams or individuals. Vesting schedules can aid retention. Requires more creative management. Employees may see options as less certain than cash. When many companies are offering options, they do little to engender loyalty. They also create a tax liability to employees. Options/profit suited to sharing profits or ownership with all employees. Strictly regulated, they may not be used for specific teams or individuals. Leveraged employee stock option plan: Stock all employees by creating a retirement benefit with tax benefits for the company. Not suited to providing a performance incentive except to the degree that it makes employees feel and act like owners of the company. It offers no stock options stock Horn has no program to take it public. DO IT [ top ] Meet with a qualified profit-sharing-plan consultant. To find one, contact program Foundation for Enterprise Development See Resources. Get clear on your objectives for the plan. Is it meant to aid hiring, retention, or productivity? Is it geared for everyone or a key few? Approach the process with an open mind. Not every company needs to offer stock options. Be creative in structuring your profit-sharing plan to achieve your desired objectives. Whatever your inclination, remember that the most effective plans integrate profit or equity sharing with the development of a culture of ownership. That means sharing information with employees, involving them in planning and decisions, and providing them with the education and tools needed to perform their best. Stock the plan and employee participation. As the company grows and its revenue picture and staffing needs change, the plan itself may also need to change. RESOURCES [ top ] Books Gainsharing and Power: Internet Sites Foundation for Enterprise Development Employee Benefit Research Institute The National Center for Employee Ownership Scanlon Leadership Network Article Contributors Writer: Get started Read More ….

No one was at the counter, and after waiting a while I was able to have someone call them to get the agent back to the counter.

The Life of Robert Louis Stevenson for Boys and Girls (English) (as Contributor).

The British Parliament levied taxes on the Colonists but the colonists did not believe they were represented in the Parliament, th.

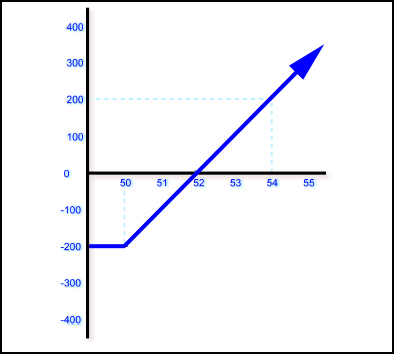

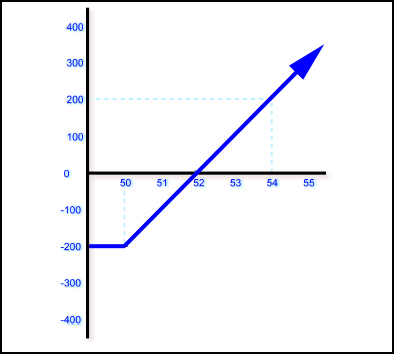

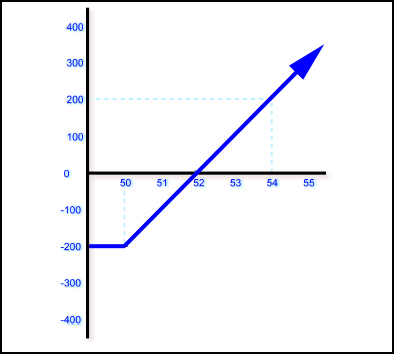

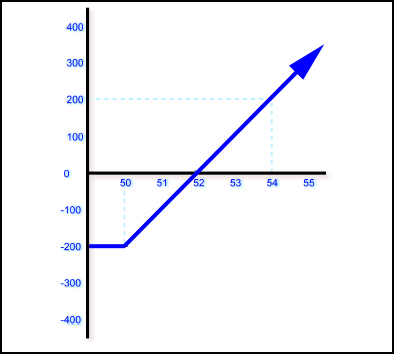

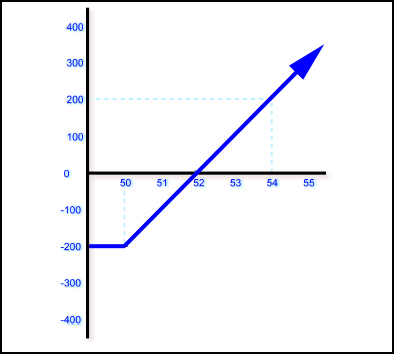

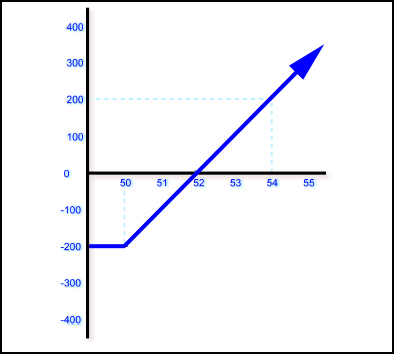

Geometric mean can not b calculated as there are some negative values and zero values present in the data.

He allows the knights to administer and advice him on matters pertaining the kingdom.