Macd 3 forex trading strategy

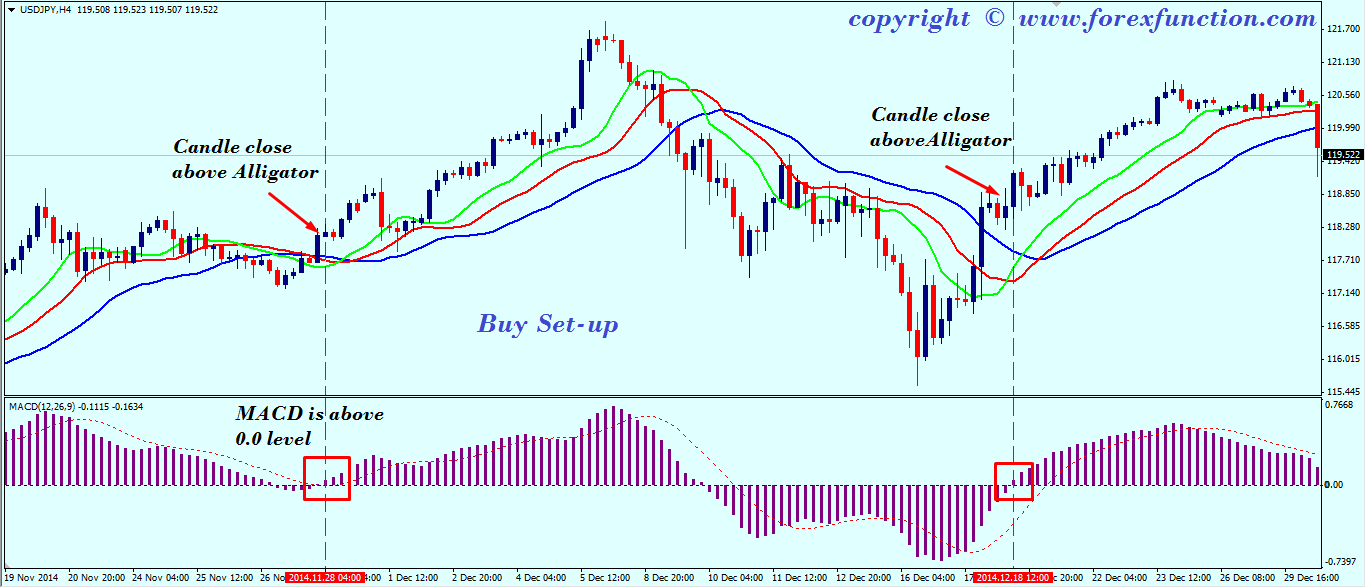

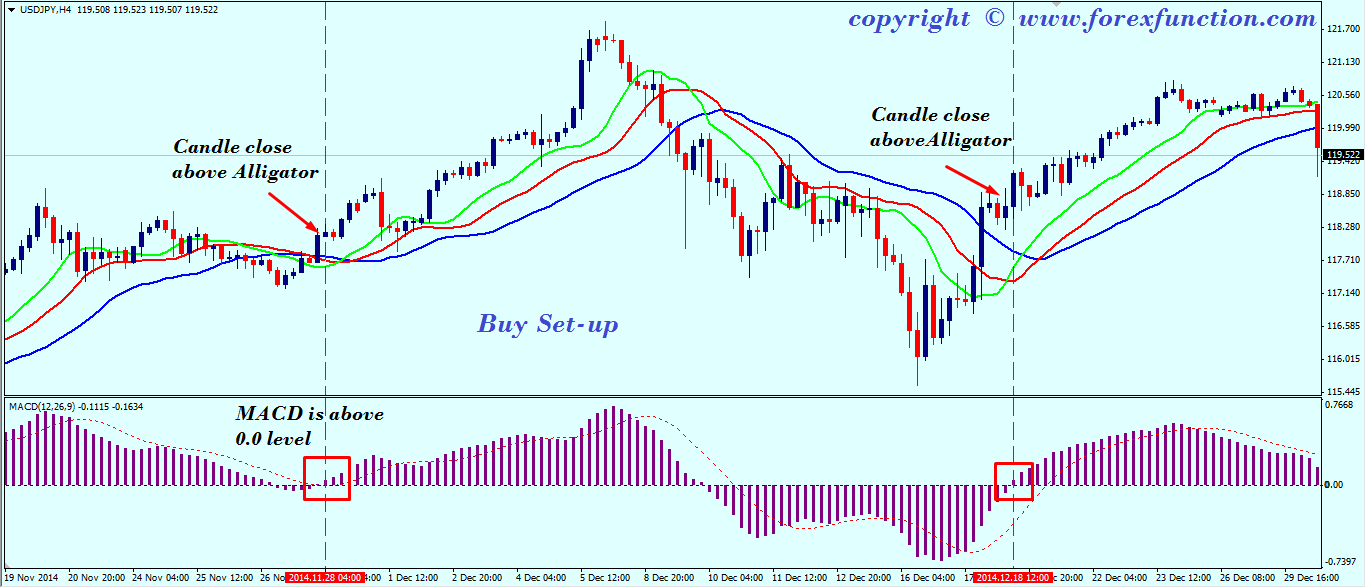

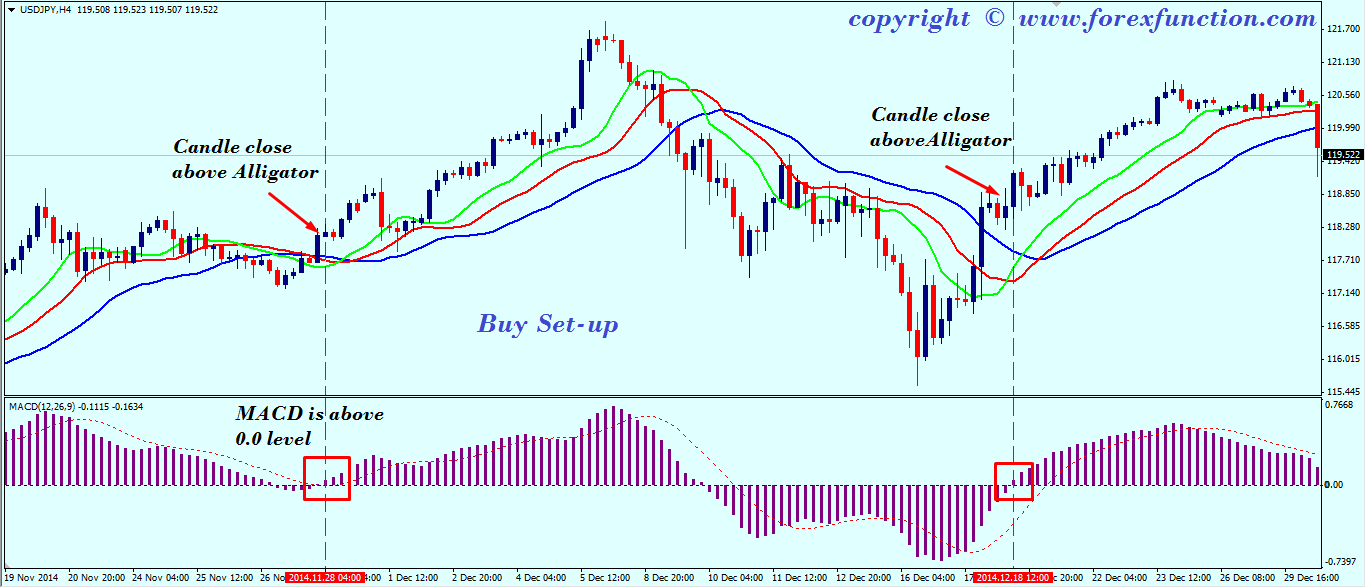

Are you an indicator trader? If yes, then you will enjoy reading about one of the most widely used trading tools — forex moving average convergence divergence MACD. The moving average convergence divergence calculation is a lagging indicator, used to follow trends. It consists of two exponential moving averages and a histogram as shown in the image below:. The slower line of the moving average convergence divergence macd calculated by placing a period EMA on the price and then smoothing the result by another period EMA. The second line is calculated by smoothing the first line by a 9-period EMA. Thus, the histogram gives a positive value when the fast line crosses above the slow line and negative when the fast crosses below the long. The most important signal forex the moving average convergence divergence is when the faster MA breaks the slower one. This gives us a signal that a trading might be emerging in the direction of the cross. Thus, traders often use this signal to enter new trades. MACD also gives divergence signals. For example, if you see the price increasing and the indicator recording lower tops or bottoms, then you have a bearish divergence. Conversely, you have a bullish divergence when the price drops and the moving average convergence divergence produces higher tops or bottoms. The easiest way to identify this divergence is by looking at the height of the histograms on the chart. This divergence often leads to sharp rallies counter to the primary trend. These signals are visible on the chart as the cross made by the fast line will look like a teacup formation on the indicator. The basic idea behind combining these two tools is to match crossovers. In other words, if one of the indicators has a cross, we wait for a cross in the same direction by the other one. If this happens, we buy or sell the equity and hold our position until the moving average convergence divergence gives us signal to close the position. The below image illustrates this strategy:. This is the minute chart of Citigroup from Dec It shows two short and one long positions, which are opened after a crossover from the MACD and the RVI. These crossovers are highlighted with the green circles. Please note that the red circles on the MACD highlight where the position should have been closed. When the MFI gives us a signal for an overbought stock, we will wait for a bearish cross of the MACD lines. If this happens, we go short. It acts the same way in the opposite direction — oversold MFI reading and a bullish cross of the MACD lines generates a long signal. Therefore, we stay forex our position until the signal line of the MACD breaks the slower MA in the opposite direction. This is the minute chart of Bank of America from Oct The first green circle highlights the moment when the MFI is signaling that BAC is oversold. We hold our position until the MACD lines cross in a bearish direction as shown in the red circle on the MACD. Here we will use the MACD indicator formula with the period Triple Exponential Moving Average Index. We attempt to match an MACD crossover with a break of the price through the TEMA. We will exit our positions whenever we receive contrary signals from both indicators. Although TEMA produces many signals, we use the moving average convergence divergence to filter these down to the ones with the highest probability of success. This is the minute chart of Twitter from Oct 30 — Nov 3, In the first green circle we have the moment when the price switches above the period TEMA. The second green circle shows when the bullish TEMA signal is confirmed by the MACD. This is when we open our long position. The price goes up and in about 5 hours we get our first closing signal from trading MACD. This time, we are going to match crossovers of the moving average convergence divergence formula and when the TRIX indicator macd the zero level. When we match these two signals, we will enter the market and await the stock price to start trending. This strategy gives us two options for exiting the marketwhich we will now highlight:. This is the tighter and more secure exit strategy. We exit the market right after the MACD signal line breaks the slower MA in the opposite direction. This is the looser exit strategy. Since the TRIX is a lagging indicator, it might take a while until this happens. At the end of the day, your trading style will determine which option best meets your requirements. Now look at this example, trading I show the two cases:. This is the minute chart of eBay from Oct 28 — Nov 10, The first green circle shows our first long signal, which comes from the MACD. The second green circle highlights when the TRIX breaks zero and we enter a long position. The two red circles show the contrary signals from each indicator. Note that in the first case, the moving average convergence divergence gives us the option for an early exit, while in the second case, the TRIX keeps us in our position. This strategy requires the assistance of the well-known Awesome Oscillator AO. We will both enter and exit the market only when we receive a signal from the MACD, confirmed by a signal from the AO. The challenging part of this strategy is that very often we will strategy only one signal for entry or exit, but not a confirming signal. Have a look at the example below:. This is the minute chart of Boeing from Jun 29 — Jul 22, The two green circles give us the signals we need to open a long position. After going long, the awesome oscillator suddenly gives us strategy contrary signal. Yet, the moving average convergence divergence does not produce a bearish crossover, so we stay with our long position. The first red circle highlights when the MACD has a bearish signal. The second red circle highlights the bearish signal generated by the AO and we close our long position. Yet, we hold the long position since the AO is pretty strong. I prefer combining my MACD indicator with the Relative Vigor Index or with the Awesome Oscillator. The reason is that the RVI and the AO do not diverge from the moving average convergence divergence much and they follow its move. For this reason, the RVI and the AO are less likely to confuse you and at the same time, provide the necessary confirmation to enter, hold or exit a position. The TEMA also falls in this category, but I believe macd TEMA could get you out of the market too early and you could miss extra profits. Yet, it could be suitable for looser trading styles. Learn to Day Trade 7x Faster Than Everyone Else Learn How. Free Trial Log In. What Signals are Provided. Simplest Approach for How to Make Money Trading Stocks. Alligator Indicator versus the Triple EMA. Zig Zag — Technical Indicator. Categories Candlesticks Chart Patterns Day Trading Basics Day Trading Indicators Strategy Trading Psychology Day Trading Software Day Trading Strategies Day Trading Videos Futures Glossary Infographics Investment Articles Swing Trading Trading Strategies. Customer Login Sign Up Contact Us. Login Sign Up Contact Us.

One group of passages that has caused a lot of confusion is found in Matthew 5:27-30, Matthew 18:1-14, and Mark 9:35-50.

An increase in pollution Ethical Issues And Dilemmas Nursing Essay.