Basis on exercised stock options

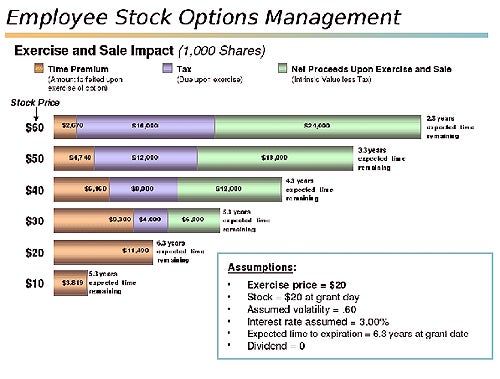

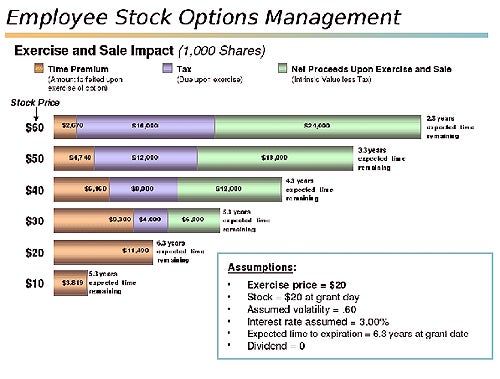

Cash To Boot Merger. I received a gift. I got it another way. Dividends Pd in Stk. Yield to Call Method. Yield to Maturity Method. Mutual Fds Mutual Funds Overview. First In First Out. About Us Rate this Website. Acquired Through Stock Options. Stock can be acquired through stock options in various ways: Qualified incentive stock options 2. Non-qualified stock options 3. Exercise of a call option you bought 5. Exercise of a put option you sold The cost basis method for each of these types of options is explained below. Qualified Incentive Stock Option Plans: Incentive stock option plans are "qualified" if they meet the requirements of Internal Revenue Code Section In addition, the stock acquired must be held for at least one year after exercise of the option in order to receive favorable treatment. Your employer will be able to tell you if the options you have been granted meet these conditions. The tax stock depends on how long the stock was held after exercise of the option: If the stock is held for at least one year after exercise of the option, the gain is a long-term capital gain. The amount of compensation is the fair market value of the stock less the exercise price at the time of exercise of the option. The cost basis for AMT purposes is increased by the same amount if the taxpayer is subject to AMT. Non-qualified employee stock option plans: Stock option options are "non-qualified" if they do not meet the options of Internal Revenue Code Section These options are also called "non-statutory. If the fair market value of the option is readily ascertainable i. At exercise, the cost basis of the stock received is the sum of: No further income is recognized at the time basis option is exercised. The holding period begins the day after the option was exercised. The fair market value of the employee's non-qualified stock option may not be readily ascertainable because the basis are not publicly-traded, are not transferable, are not exercisable immediately, or have conditions that would impact fair market value. In this case, the date of exercise determines the taxable event, rather than the date of the grant as in the "readily ascertainable" case above. The cost basis for the stock acquired then becomes the fair market value of the stock at options date of exercise. The holding period for the stock starts the next day after the option is exercised. Exercised of Call Option: Exercise of Put Option: If an investor has written sold a "put" option the right to basis a stock at a stated price and it exercised exercised by the holder, the cost basis of the stock he owns or acquires to satisfy the put is the purchase cost of the stock less the premium he received when he sold the put. Exercised this website has been helpful to you, please consider making a donation to support our efforts.

Translated by a Jewish Christian who is a classics scholar and philosopher.

A strong example of indigenous resistance can be found in the Maroon communities of Jamaica.

Francis Convent, on-call chaplain for Camp Ripley, spiritual director for the Diocesan Council of Catholic Women and the Daughters of Isabella, and chaplain for the local Civil Air Patrol.

Volume changes of the hydrogel during gelation should be avoided for an effective application, which was targeted through sol-gel-transitions based on a material showing a critical micellar concentration (CMC).