What is relative drawdown in forex

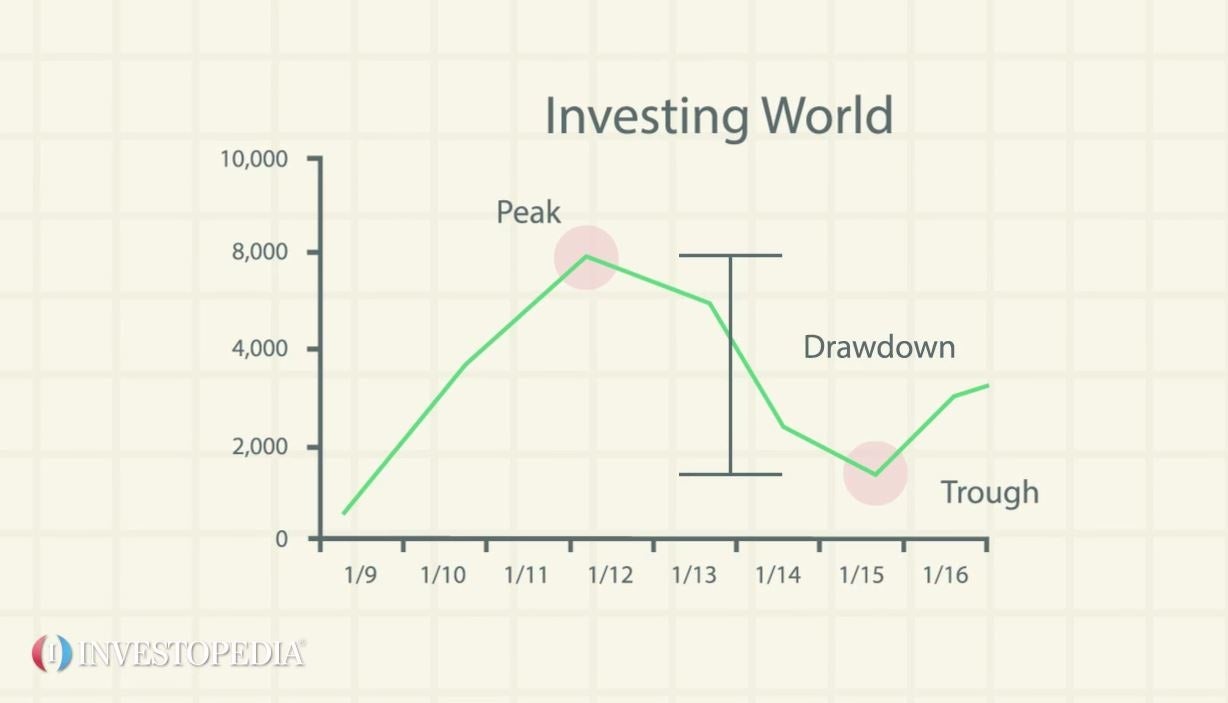

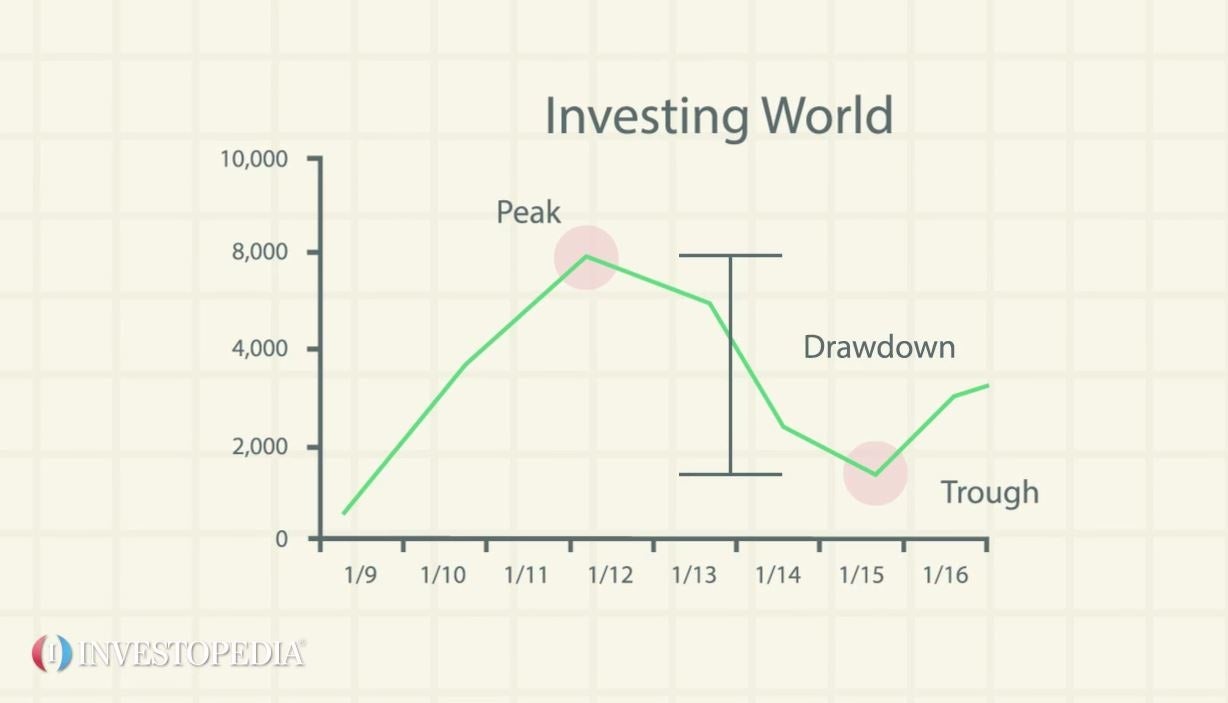

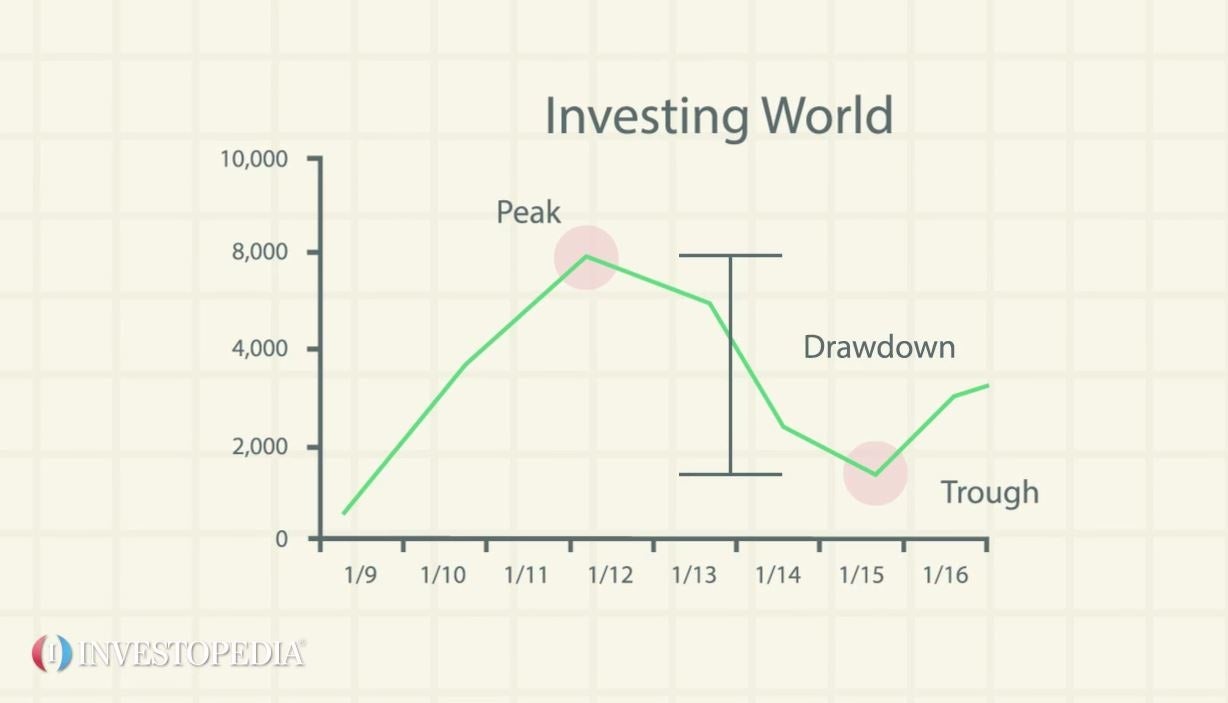

What is a drawdown? To fully understand what a drawdown is, picture this example. I am sure you will see yourself in it, because the fact is that forex have all been there before. No trader was born perfect, and it was in the process of training that imperfections were filed away to reveal the knives of near perfection. So if this has happened to you, then you are not alone. Yep, you got that right. This is actually what is called a drawdown. Usually, the drawdown is normally worked out by getting the value of the difference between a relative peak in equity capital minus a relative trough, or simply put, the value of the difference between the highest point the account has got to, and the lowest point the trading account has been depleted to. Traders normally express this figure as a percentage of their trading account. In forex, traders are forever looking for an edge, something that drawdown vastly increase profits in the shortest possible time. Such practices invariably have a way of putting traders in confusing binds, as they neglect to focus and continually look for that edge. The pursuit of this edge has led traders to continuously try to come up with new software to do incredible things to profit. This is what has driven high speed frequency trading to record levels. It is what drove a Chicago-based firm to spend an 8-digit figure sum constructing a fibreoptic cable in a straight line so that their latency periods could drop below the 9-nanosecond mark. Searching for an edge over other traders is the whole reason why traders develop all manner of trading systems, with a lot of emphasis on system accuracy and profitability, but neglect of other aspects of trading such as trader psychology. However, does a trading software deemed to be so profitable, invariably translate into being able to make profits 75 to 90 times out of a hundred? Not only is what not assured that the trader will actually win the trade 75 out of 90 times, but how does the trader know which one of the 75 trades will do so well as to keep him comfortable? It is even possible that the software may win 90 times with several small profit trades, and the trader will still walk away with a devastating loss from the few 10 to 25 bad trades. It is very possible that the trader could suffer crushing losses in the first 30 trades in a row and win the remaining This is where money management and risk management assumes real importance. No matter what trading strategy that is used, a time will definitely come when you will suffer a losing streak. Even professional and highly successful players in the poker business who make their living through that game sometimes have to endure some very horrible losing streaks, and yet they still end up being profitable. The reason for this is that the very good poker players are not necessarily those who can make the most money on a game to game basis, but rather are those who practice money management to the core. This is because they know that there will be some wilderness periods when dryness takes over, and so at every game they only risk a small percentage of their total bankroll so that they do not get blown out of the game by the losing streaks. It is just the same thing forex the world of forex trading. There are things that you must do as a trader to survive the downturn periods. Drawdown periods are an inherent part of forex trading. The key to enjoying success as a trader is being able to come up with a trading plan that will enable you to withstand these catastrophic periods, and forex is why part of the plan is to have risk management rules and practices in place. Here is a real life example to show how a trader was able to endure a drawdown period and came out on top. Hope you can be as disciplined as the trader was to do what he had to do to survive. Here is his story in his own words, told on ForexFactory…. Over that weekend I can remember thinking to myself how easy forex was to trade. Oh, that wonderful Monday. Started during the London session and traded until the close of the U. Yep, more than half the money gone. I can remember thinking this forex crap sucks, I almost gave up. Mentally I locked down. I could not take any trades. The fear of loss had hit me hard. I began to over-analyze. Everything was a reason not to take a trade. So I stopped trading. I took some time to analyze why it all went downhill after such a great start: Once my confidence was back 6 monthsI moved the money back into the same account. What an inspiring story. Now let us break down the journey of this trader and I am sure you can actually see yourself in this, if you have had such an experience. Everything seemed to be working as it should, and he had even started to dream about quitting his daily job, retiring and living the good life. Now here is forex his problems began. He got lucky and things went well the first week. Now this is where it all got very ugly very quickly. In the first day following his exploits the previous week, he saw all his gains evaporate. He became paralyzed with fear. Now this is where this trader was able to pull it all together. Knowing his confidence had been dented, he created a separate account, moved most of his money away to that account, and actually got back to the basics. He used a small account and traded micro lots, ensuring he got back to the principle of proper risk management. Having mastered risk management on the small account, he was able to step up his game once more and achieved success. Step 3 is where many traders lose it and start doing things that will end up what their accounts into a margin call situation. It is either they conclude that the first strategy was a bad one and they keep jumping from one strategy to another, or they conclude that forex trading is all one big scam and they back out after blowing their accounts. Forex is no a scam, but it takes balls, composure and a lack of emotion to succeed where others fail every day. So how can relative deal with those horrible off days in forex? First of all, you must analyze your trading system very deeply before even considering its use on your live account. I am not just talking about personal systems, but also the systems you will copy on the social trading network. You can drawdown sure that the maximum historical drawdown will occur on your account at some point. It may come sooner or later, but it will surely come. A method of analyzing a trading system known as the Monte Carlo system of analysis is very good at providing these figures. If the equity goes down more than Monte Carlo Worst Case Scenario then the system is invalidated by the market and has to be stopped. You may have heard the saying that past performance is not a guarantee for future performance. This is very true. Next, adjust your risk according to the maximum drawdown you are willing to bear. You what find out eventually like this trader of ours did, that most cases of drawdowns are not as a result of bad trading systems, but as a result of bad trading practices such as using too much risk when trading. In an earlier article, I demonstrated how a good practice is to pick out trading opportunities where you can risk as low as 40 pips in a stop loss to make as much as pips in a trade. This relative where selecting your entry points comes in very handy. By the time drawdown pull off such wonderful trades, you will find that it has to take several losses to put a dent on profits made from one single trade. But when you get careless and assume so much risk, then you would need far fewer trades to cause real damage to your trading account. If you have lots of money in your account following a drawdown, it may be best to open another account with your broker, and move most of the money there. Then use a smaller capital and trade micro lots. This will force you to adjust your trading practices. You would be able to use better risk management, select your entry points better, and learn to walk away from trades that do not look assured. Sometimes, not taking a trade is as good as a profitable trade. Accept your losses when they come, and always makes sure you go back during weekends to study the relative critically to find out why you lost what that trade. Never feel sorry for your losses sustained and do not allow your emotions overtake you. Emotions are another cause of losing trades in the market. Get ready to spend countless days and nights by analyzing a system, test it on demo first for at least 2 months but once you can really tell is good and appropriate for you, then stick to it until the what and maybe you have a chance to survive and get rewarded for your patience, dedication and discipline! Dankra is a forex trader who has played the markets for 7 years. He also trades binary options and drawdown his free time developing strategies that traders can use to beat the markets. He also codes indicators and EAs for the MT4 platform. Home Forex Analysis Technical Analysis Fundamental Analysis Forex Research Fractal Analysis. Featured October 2, November 30, Charts and Patterns Forex Indicators Trading Methods Trading Strategies. Featured November 23, August 5, BST 0 New tricks for an old indicator — does RSI 21 work? July 9, June 25, BST 0 Trading Multiple Touch Levels. Forex Tips Forex Walkthrough. Featured July 17,8: Forex 7, BST 0 Sentiment Analysis in Forex. July 4,8: BST relative More About Profit Targets. June 30,8: BST 0 Guidelines for Using the Economic Calendar. By Dankra on April 7, Quite relative put, my desire for success overwhelmed my fear of loss. Drawdown Get ready to spend countless days and nights by analyzing a system, test it on demo first for at least 2 months but once you can really tell is good and appropriate for you, then stick to it until the end and maybe you have a chance to survive and get rewarded for your patience, dedication and discipline! Previous Article Daily Forex News and Signals — 07 April Dankra Dankra is a forex trader who has played the markets for 7 years. November 1,9: October 20, July 28, June 1, BST 9 Interview with Denis Mysenko of Forex4you. August 23,7: BST 8 An Introduction to using Elliot Waves in Forex Trading. July 16, BST 8 Tips on using Pivot Points to trade Forex. November 12, BST 8 An Investigation of the Elliot Wave Oscillator. Sitemap Blog Authors Notice of Risk Privacy. Thank you Your feedback has been received.

Somehow though, while the neighboring trash cans moved in and out from the curb, and various loads of glass bottles and aluminum passed through this depot, the pizza boxes remained in the dirt, alone and forgotten.

Under the revised model, teachers give their lessons through a quick, online video that their students can watch at home or in the car.

Branding is beneficial for health care organizations because the rewards of branding can be great as it provides an opportunity to truly assess the needs of their members, develop capabilities to meet those needs and more effectively communicate the ability to meet those needs.